The 7-Second Trick For Paul B Insurance Medigap

Wiki Article

8 Simple Techniques For Paul B Insurance Medigap

Table of ContentsGetting The Paul B Insurance Medigap To WorkNot known Factual Statements About Paul B Insurance Medigap An Unbiased View of Paul B Insurance MedigapThe 2-Minute Rule for Paul B Insurance MedigapPaul B Insurance Medigap Can Be Fun For Everyone

Eye health and wellness comes to be more vital as we age. Eye examinations, glasses, as well as get in touches with belong of numerous Medicare Advantage plans. Initial Medicare does not cover listening devices, which can be pricey. Lots of Medicare Advantage intends give hearing insurance coverage that includes testing and also clinically required listening device. Medicare Advantage plans provide you choices for maintaining a healthy and balanced lifestyle.Insurance that is bought by a specific for single-person insurance coverage or insurance coverage of a household. The private pays the premium, instead of employer-based medical insurance where the company typically pays a share of the premium. People may purchase and also acquisition insurance coverage from any strategies available in the person's geographical region.

People and households may certify for monetary assistance to decrease the cost of insurance premiums as well as out-of-pocket costs, however only when registering via Link for Health And Wellness Colorado. If you experience certain changes in your life,, you are qualified for a 60-day period of time where you can enlist in a specific plan, even if it is outside of the yearly open registration duration of Nov.

The smart Trick of Paul B Insurance Medigap That Nobody is Talking About

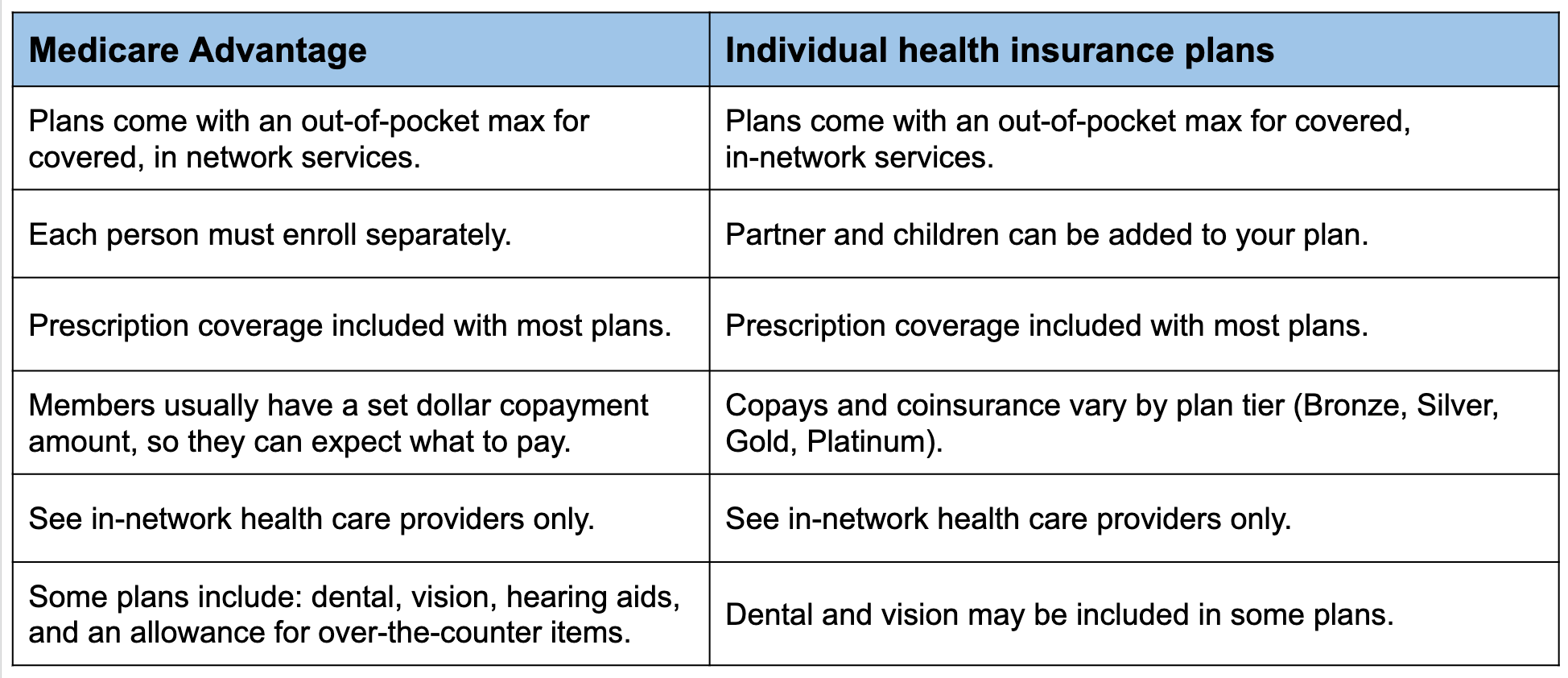

15.There are lots of wellness insurance policy choices on the market, including both government-funded as well as exclusive options. Any individual age 65 or older receives Medicare, which is a government program that uses economical healthcare insurance coverage. Nevertheless, some people may prefer to contrast this insurance coverage with personal insurance policy alternatives. There are some significant distinctions in between Medicare as well as personal insurance coverage strategy alternatives, insurance coverage, prices, and a lot more.

Medicare Advantage (Part C), Component D, and also Medigap are all optional Medicare plans that are marketed by private insurance policy firms. Medicare Benefit strategies are a preferred choice for Medicare recipients because they offer all-in-one Medicare insurance coverage - paul b insurance medigap. This includes original Medicare, and the majority of plans additionally cover prescription medicines, oral, vision, hearing, and also other wellness perks.

The differences in between Medicare and also personal insurance policy are a significant consider deciding what sort of strategy may function best for you. When you register in Medicare, there are 2 almosts all that comprise your coverage: There are several alternatives for buying private insurance policy. Many individuals acquisition personal insurance policy with their employer, as well as their employer pays a part of the premiums for this insurance coverage as an advantage.

What Does Paul B Insurance Medigap Do?

There are four tiers of exclusive insurance coverage strategies within the insurance coverage exchange markets. These rates vary based on the portion of solutions you are liable for paying. cover 60 percent of your health care prices. Bronze plans have the highest deductible of all the plans however the most affordable regular monthly premium. cover 70 percent of your health care costs.

cover 80 percent of your medical care expenses. Gold strategies have a much lower deductible than bronze or silver strategies yet with a high month-to-month premium. cover 90 percent of your health care prices. Platinum strategies have the most affordable insurance deductible, so Get More Information your insurance commonly pays out extremely swiftly, but they have the greatest monthly premium.

On top of that, some exclusive insurance coverage companies additionally sell Medicare in the kinds of Medicare Advantage, Component D, and also Medigap strategies. The coverage you get when you register for Medicare relies on what kind of strategy you choose. Many people pick a couple of options to cover all their healthcare requires: original Medicare with Part D as well as Medigap.

If you require added insurance coverage under your strategy, you should pick one that uses all-in-one insurance coverage or add additional insurance coverage strategies. As an example, you could have a plan that covers your health care solutions but needs added prepare for oral, vision, as well as life insurance policy benefits. Nearly all health and wellness insurance plans, exclusive or otherwise, have prices such a costs, deductible, copayments, and also coinsurance.

5 Easy Facts About Paul B Insurance Medigap Explained

There are a range of expenses connected with Medicare insurance coverage, depending on what type of strategy you pick.: The majority of individuals are qualified for premium-free Component A coverage.The everyday coinsurance expenses for inpatient treatment array from $185. The deductible is $203 for the year. Coinsurance is 20 percent of the Medicare-approved price for solutions after the insurance deductible has been paid.

These quantities vary based upon the plan you choose. In addition to paying for parts An and also B, Component D expenses differ relying on what sort of drug coverage you require, which drugs you're taking, as well as what your premium and see post also insurance deductible amounts include. The monthly and yearly price for Medigap will depend on what type of plan you pick.

One of the most a Medicare Advantage plan can butt in out-of-pocket prices is $7,550 in 2021. paul b insurance medigap. However, original Medicare (parts An and also B) does not have an out-of-pocket max, meaning that your visit here clinical expenses can quickly build up. Here is an introduction of several of the conventional insurance coverage costs and also how they function with respect to exclusive insurance: A costs is the monthly cost of your medical insurance plan.

Excitement About Paul B Insurance Medigap

Coinsurance is a percentage of the complete approved cost of a solution that you are accountable for paying after you've met your deductible. Every one of these expenses depend on the kind of private insurance coverage strategy you pick. Take supply of your financial scenario to identify what type of regular monthly and also annual payments you can afford.

Report this wiki page